7th CPC Pay Fixation: Confederation seeks Clarification for Post-2016 Promotee/MACP and One time relaxation in excercise option for retrospectively Promotion/Upgradation

IMPORTANT

No.Confdn/7th CPC/Option/2016-17

10-10-2016

To10-10-2016

Shri.R.K.Chathurvedi,

Joint Secretary to Govt. of India,

Ministry of Finance,

Department of Expenditure

(Implementation Cell),

Room No.124, The Ashok, North Block,

New Delhi 110 001.

Sir,

Sub: Exercising option for pay fixation in the revised 7th CPC Pay Structure, from the date of promotion or from the date of next increment from 01.01.2017 C/o.Officials who are due for promotion/upgradation from Grade Pay 2800 to 4200 during the period from 01.01.2016 to 01.07.2017 . Request clarification and permission to exercise revised option as a one-time measure.

1. As per Rule 5 of CCS (RP) Rules, 2016 the following provisions are notified by Government on 25.07.2016:

Rule 5 : Government servant may elect to continue to draw pay in the existing pay structure until the date on which he earns his next increment or any subsequent increment in the existing pay structure or until he vacates his post or ceases to draw pay in the existing pay structure.

Provided further that in cases where a Government servant has been placed in a higher grade pay or scale between 1st day of January 2016 and the date of notification of these rules (ie. 25.07.2016) on account of promotion or upgradation, the Government servant may elect to switch over to the revised pay structure from the date of such promotion or upgradation as the case may be.

2. As per the above two provisions, a Government servant may elect to continue to draw pay in the existing pay structure until he earns his next or any subsequent increment in the existing (pre-revised) pay structure which implies that in cases where there is no promotion/upgradation between 01.01.2016 to 30.06.2016 (or between 01-01-2016 to 30-06-2017 in the case of subsequent increment on 01-07-2017) option to opt from the date of next increment (01.07.2016) or subsequent increment (01.07.2017) is available, thereby forgoing the arrears from 01.01.2016 to 30-06-2016 (next increment) or upto the date of subsequent increment say, 01.07.2017.

3. Thus, in the case of promotion/upgradation of a Government Servant becoming due before the date of notification ie, 25.07.2016, he should elect to switch over to the revised pay structure from the date of such promotion/upgradation. He has no option to opt for the next increment (becoming due after the date of promotion/upgradation) for fixation of pay in the revised pay structure.

4. Subsequently a clarificatory order is issued by Department of Expenditure (Implementation Cell) on 29th September 2016, which clarified the position further. As per this clarification, in case an employee is promoted or upgraded to the higher pay structure (in the pre-revised pay structure) he may be permitted to exercise revised option to have his pay fixed under the Revised Pay Rules 2016 from the date of such promotion/upgradation or from the date of next increment as per FR-22(i)(a)(i).

5. Thus an official who got promotion/upgradation on 15.07.2016 (in the month of July 2016), can exercise option to fix his pay under Revised Pay Rules, 2016, either from the date of promotion or from the date of next increment ie; on 01.07.2017.

6. Even after issuing the above clarificatory orders, dated 29.09.2016, it is not clear, whether an employee who becomes eligible for promotion/financial upgradation on a date after the date of issue of notification, ie, 25-07-2016, but before the date of next increment ie. 01.07.2017, can exercise option now, for fixation of his Revised Pay as per CCS (RP) Rules, 2016, from the date of promotion or from the date of next increment, ie; 01.07.2017, by forgoing the arrears from 01-01-2016 to date of promotion or 30.06.2017, thus allowing him to draw his pay in the pre-revised pay structure of 6th CPC till the date of promotion or till the date of next increment on 01-07-2017. As per the existing orders, all those employees whose date of promotion/upgradation becomes due after 25.07.2016 should compulsorily opt for pay fixation from 01.01.2016 or 01-07-2016, whereas an employee whose promotion is due in July 2016 ie; before the date of notification (25.07.2016) can opt for next increment date on 01.07.2017 for fixation in the Revised Pay structure under FR-22(i)(a)(i). Since the benefit is extended to a section of employees who were promoted between 01-01-2016 and 25.07.2016 and the same benefit is denied to the rest of the employee who are promoted after 25.07.2016, this is a clear case of discrimination and denial of natural and equitable justice.

7. If the option as above is not allowed, thousands of employees who are due for promotion/financial upgradation from 2800 Grade Pay to 4200 Grade Pay (in the pre-revised pay structure) from a date after the date of notification ie. 25.07.2016, will suffer a recurring loss of Rs.2800 to 3000 per month, throughout their service.

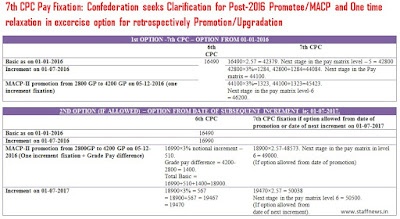

The following illustrations will explain the above facts:

1st OPTION 7th CPC : OPTION FROM 01.01.2016

| ||

| 6th CPC | 7th CPC | |

| Basic as on 01.01.2016 | 16490 | 16490×2.57 = 42379. Next stage in the pay matrix level - 5 = 42800 |

| Increment on 01.07.2016 | 42800×3%=1284, 42800+1284=44084. Next stage in the Pay matrix = 44100. | |

| MACP-II promotion from 2800 GP to 4200 GP on 05.12.2016 (one increment fixation) | 44100×3%=1323, 44100+1323=45423. Next stage in the pay matrix level-6 = 46200. | |

2ND OPTION (IF ALLOWED) : OPTION FROM DATE OF SUBSEQUENT INCREMENT ie; 01.07.2017.

| ||

| 6th CPC | 7th CPC fixation if option allowed from date of promotion or date of next increment on 01.07.2017 | |

| Basic as on 01.01.2016 | 16490 | |

| Increment on 01.07.2016 | 16990 | |

| MACP-II promotion from 2800GP to 4200 GP on 05-12-2016 (One increment fixation + Grade Pay difference) | 16990×3% notional increment - 510. Grade pay difference = 4200-2800 = 1400. Total Basic = 16990+510+1400=18900. | 18900×2.57-48573. Next stage in the pay matrix in level 6 = 49000. (If option allowed from date of promotion) |

| Increment on 01.07.2017 | 18900×3% = 567 = 18900+567 = 19467 = 19470 | 19470×2.57 = 50038 Next stage in the pay matrix level 6 = 50500. (If option allowed from date of next increment). |

Thus if no option is permissible after 25.07.2016 to fix the pay in the revised scale on the date of promotion ie. 5.12.2016, then by compulsory option from 01.01.2016, the pay will be fixed at 46200 on promotion. If option is permissible after the date of notification to fix the pay in the revised scale on the date of promotion, the pay will be fixed at 49000. The difference is Rs.2,800/-. If option for fixation on next increment on 01.07.2017 is granted, then the difference will increase further.

In view of the above, it is requested that the case may be reviewed judiciously and clarificatory orders may be issued, permitting the employees whose promotion date become due after the date of notification (25.07.2016) also, to exercise option for fixation of their revised pay from the date of promotion/upgradation or from the date of next increment ie. 01.07.2017, as a one time measure, thereby forgoing the entire arrears from 01.01.2016 to date of promotion or date of next increment on 01.07.2017. In other words, they may be permitted to draw their pay in the pre-revised 6th CPC pay structure till the date of promotion or till the date of next increment on 01.07.2017.

Awaiting favourable orders,

Yours faithfully,

M.Krishnan,

Secretary General,

&

Standing Committee Member,

JCM National Council (Staff side).

Mob: 09447068125.

Source : ConfederationhqSecretary General,

&

Standing Committee Member,

JCM National Council (Staff side).

Mob: 09447068125.