Pay Fixation on Promotion or MACP in 7th CPC – Option Calculation with illustrations

7th CPC Promotion Option Calculation

All the central government employees are in busy with calculating which Option is beneficial to them in order to get full benefit from 7th CPC Revised pay .Actually there is no dilemma for CG employees those who didn’t get any Promotion/MACP from 1st January to 1st July 2016. There are some cases in this category that choosing Option to revise Pay from Date of Next Increment gives more benefit than opting 1.1.2016 to revise 7th CPC Pay .

The government servants those who got Promotion / MACP in the Period from 2nd January to 1st July are finding it difficult to decide which Option is correct and More beneficial to them. No body in the administrative Department ready to guide the right way to the Government servants since there is no clarity in 7th CPC in respect of Revising/Fixing pay on Promotion Date. But It was clearly illustrated in Sixth CPC.

Let us workout the Pay Fixation in different Options to revise pay in 7th CPC to understand which Option is Beneficial in Longer run.

Let us take an example,

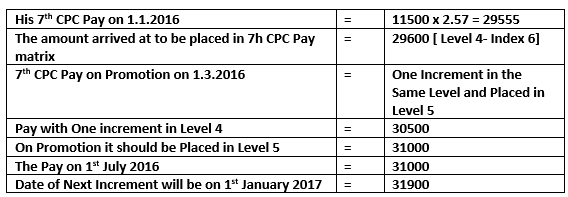

Assume a government servant has been promoted to Next Grade to 2800 on any date between 2nd January 2016 to 1st July 2016. Let us take 1st march 2016 was his date of Promotion.

His existing pay as on 1.1.2016 = Band Pay of 9100 + Grade pay of 2400 = 11500

If He Choose Option -I to revise his Pay from 1.1.2016

Since there is no Grade pay involved in 7th CPC, Adding Grade Pay difference on Promotion date is not applicable in 7th Pay Commission for this category.

Which Option is More beneficial ..?

From the above calculation, it shows that Selecting Option -II to revise Pay with effect from Date of Next Increment i.e 1st July 2016 is more beneficial than Option-I.It may differ to individual to individual based on Grade Pay and no of increments earned in that Particular Grade.

The Impact of Selecting Option -II in the above case

a. Pay revision come into force with effect from 1st July 2016,b. You have to travel in Sixth CPC Pay up to 30th June 2016

c. So There will be no arrears for the Period from January 2016 to June 2016

Source: http://7thpaycommissionnews.in/

0 comments:

Post a Comment