Delhi high court order on dearness allowance

Appeal to unfreeze the DA/DR is dismissed by Delhi High Court Order

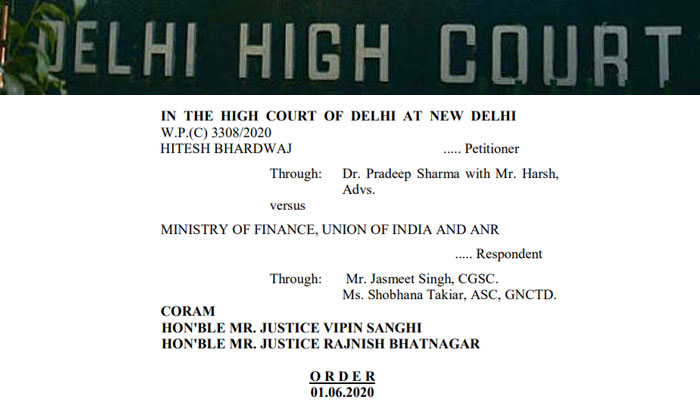

IN THE HIGH COURT OF DELHI AT NEW DELHI

W.P.(C) 3308/2020

HITESH BHARDWAJ ….. Petitioner

HITESH BHARDWAJ ….. Petitioner

Through: Dr. Pradeep Sharma with Mr. Harsh,

Advs.

versus

MINISTRY OF FINANCE, UNION OF INDIA AND ANR

….. Respondent

Through: Mr. Jasmeet Singh, CGSC.

Ms. Shobhana Takiar, ASC, GNCTD.

Advs.

versus

MINISTRY OF FINANCE, UNION OF INDIA AND ANR

….. Respondent

Through: Mr. Jasmeet Singh, CGSC.

Ms. Shobhana Takiar, ASC, GNCTD.

CORAM

HON’BLE MR. JUSTICE VIPIN SANGHI

HON’BLE MR. JUSTICE RAJNISH BHATNAGAR

O R D E R

01.06.2020

CM APPL. 11606/2020

Exemption allowed, subject to all just exceptions.The Court fees be paid within a week.

The application stands disposed of.

W.P.(C) 3308/2020

The present writ petition has been preferred in public interest seeking following reliefs:

a) Issue a Writ of Mandamus or any other appropriate Writ, order or direction to the Respondents to withdraw the notification issued by the Ministry of Finance, Government of India

b) Issue a Writ of Mandamus or any other appropriate Writ, order or direction to the Respondents to withdraw the endorsement against the notification, issued by the Ministry of Finance, Government of NCT of Delhi.

c) Issue a Writ of Mandamus or any other appropriate Writ, order or direction to the Respondents to defreeze and release the enhanced Dearness Allowance to the Central Government Servants and pensioners as per norms.

d) Issue a Writ of Mandamus or any other appropriate Writ, order or direction to the Respondents to defreeze and release the enhanced Dearness Allowance to the Government Servants and pensioners of GNCTD as per norms.”

The respondent no. 1/Union of India issued an Office Memorandum dated 23.04.2020 which is the cause for the petitioner’s grievance in the present writ petition. The said Office Memorandum reads as follows:

Freezing of Dearness Allowance to Central Government employees and Dearness Relief to Central Government pensioners at current rates till July 2021.

The petitioner is also aggrieved by the consequent order issued by respondent no. 2/GNCTD dated 24.04.2020, whereby the GNCTD has followed suit in terms of the Office Memorandum dated 23.04.2020 issued by respondent no. 1. The Office Memorandum dated 23.04.2020, in effect, conveys the decision of the Central Government that Dearness Allowance due to the Central Government Employees and Dearness Relief due to the Central Government Pensioners from 01.01.2020 shall not be paid. It also states that additional installment of the Dearness Allowance and Dearness Relief due from 01.07.2020 and 01.01.2021 shall also not be paid. Pertinently, Dearness Allowance and Dearness Relief at the current rates would continue to be paid. The said Office Memorandum further states that as and when the decision to release future installment of Dearness Allowance and Dearness Relief due from 01.07.2021 is taken by the Government, rates of the Dearness Allowance and Dearness Relief as effective from 01.01.2020, 01.07.2020 and 01.07.2021 will be restored prospectively, and will be subsumed in the cumulative revised rate effective from 01.07.2020. No arrears from the period 01.01.2020 till 30.06.2021 shall be paid.

The first submission of the petitioner is that Central Government Employees and Central Government Pensioners have a vested right to receive the enhanced Dearness Allowance/ Dearness Relief which has already been declared effective from 01.01.2020. The said increase was declared at 4%. The petitioner also claims that such employees and pensioners also have vested right to continue to receive enhancement in Dearness Allowance/ Dearness Relief on and from 01.07.2020 and 01.01.2021.

To examine the merit of this submission, we may refer to the All India Services (Dearness Allowance) Rules, 1972. These statutory rules have been framed by the Central Government after consultation with the Government of the States concerned in exercise of powers conferred by SubSection (1) of Section 3 of All India Services Act,1952. Rule 3 of the said Rule is relevant and which reads as follows:

“3. Regulation of dearness allowance:From the above Rule, it would be seen that Central Government servants shall be entitled to draw Dearness Allowance “at such rates, and subject to such conditions, as may be specified by the Central Government, from time to time, in respect of officers of the Central Civil Service, ClassI”. We may notice that there is no other statutory rule brought to our notice relating to payment of Dearness Allowance or Dearness Relief and it appears that the said Rule governs the payment of Dearness Allowance and Dearness Relief to Government servants and Government Pensioners of the Union in respect of all the classes of employees.

Every member of the Service and every officer, whose initial pay is fixed in accordance with sub-rule (5) or sub-rule (6A) of rule 4 of the Indian Administrative Service (Pay) Rules, 1954 or sub-rule (5) of rule 4 of the Indian Police Service (Pay) Rules, 1954 or sub-rule (6) of rule 4 of the Indian Forest Service (Pay) Rules, 1968, shall be entitled to draw dearness allowance at such rates, and subject to such conditions, as may be specified by the Central Government, from time to time, in respect of the officers of Central Civil Services, Class I.”

(emphasis supplied)

The above rule shows that the entitlement to draw Dearness Allowance and Dearness Relief is determined by the Central Government. The same may be specified by the Central Government from time to time, subject to whatever conditions the Government may deem fit to impose.

From the above Rule, it is clear to us that, firstly, there is no statutory rule which obliges the Central Government to continue to enhance the Dearness Allowance or Dearness Relief at regular intervals i.e. to revise the same upwards from time to time. Consequently, there is no vested right in the Central Government Employees, or Central Government Pensioners to receive higher Dearness Allowance or Dearness Relief on regular intervals.

Pertinently, by the impugned Office Memorandum, the Central Government has frozen – and not withdrawn, the Dearness Allowance and Dearness Relief being paid to Central Government Employees and Central Government Pensioners at the time of issuance of the said Office Memorandum.

Also check: Appeal to unfreeze the DA by the petitioner at Delhi High Court

So far as the submission with regard to increase of 4% Dearness Allowance or Dearness Relief with effect from 01.01.2020 is concerned, the impugned Office Memorandum does not seek to take it away. All that it does is to postpone its payment till after 01.07.2021. That power, in our view, resides with the Central Government, by virtue of Rule 3 of the All India Services (Dearness Allowance) Rule, 1972, since the Central Government is empowered to take the decision to make payment of Dearness Allowance / Dearness Relief, subject to such conditions as the Central Government may specify from time to time.

The submission of learned counsel for the petitioner is that the Central Government in the impugned Office Memorandum has referred to COVID19 pandemic as the reason for its decision contained in the said Office Memorandum. However, the impugned Office Memorandum has not been issued by the competent authority under the Disaster Management Act. We do not find merit in this submission. The provisions of the Disaster Management Act are not the only repository of the power of the Government to take action in the light of the pandemic. As noticed above, the power to determine as to how much Dearness Allowance is to be paid, i.e. at what rates, and subject to what condition, resides with the Central Government by virtue of Rule 3 of All India Services (Dearness Allowance) Rules, 1972. Merely because the said impugned Office Memorandum makes reference to the COVID-19 pandemic, it does not follow that the only provision which the respondents could have invoked are those contained in the Disaster Management Act. The Central Government, by referring to COVID-19 pandemic in the impugned communication, has merely provided its reasons and justification for its decision contained in the said Office Memorandum.

The next submission of the learned counsel for the petitioner is that the impugned Office Memorandum is also in violation of Article 360(4) (a)(i) of the Constitution of India. Article 360 of the Constitution of India contains the provision as to financial emergency, and it provides that if the President is satisfied that a situation has arisen whereby the financial stability of credit in India or any part of the territory thereof is threatened, he may, by a proclamation make declaration to that effect. The submission is that President of India has not declared financial emergency. The further submission is that it is only during financial emergency declared by the President, that by virtue of Sub-Article 4(a)(i) – a provision could be made requiring reduction of salaries and allowances of all or any class of persons serving in connection with the affairs of the State. Since no financial emergency has been declared, the Office Memorandum in question could not have been issued which is referable to Article 360(4)(a)(i) of the Constitution of India.

We find this submission to be completely misplaced. This is for the reason that Article 360(4)(a)(i) deals with a situation where the Government seeks to reduce the salary or allowance of all, or any class of persons, serving in connection with the affairs of the State. In the present case, the Office Memorandum does not seek to reduce either the salaries or allowances, which includes Dearness Allowance and Dearness Relief in respect of serving Government servants, or its pensioners. All that it does is to freeze the payment of Dearness Allowance and Dearness Relief at the pre-existing level, and to put in abeyance any increase in Dearness Allowance and Dearness Relief till July, 2021. The said freeze does not tantamount to reduction of either salary, or allowances, of persons serving in connection with the affairs of the State.

The further submission submission of learned counsel for the petitioner is that the Office Memorandum could not have been issued by mere issuance of an office order, and the same should have been either framed as a statutory rule, or by issuing a gazette notification. We do not find any basis for this submission. We have noticed Rule 3 of the All India Services (Dearness Allowance) Rules, 1972. The said Rule does not state that the Central Government can form, or communicate, its decision with regard to entitlement to draw Dearness Allowance, subject to conditions, only by framing another rule, or by a gazette notification. There is no such requirement in law. Therefore, we do not find any merits in this submission as well.

Also check: Expected DA 2020

So far as the right to receive the increase of Dearness Allowance / Dearness Relief already declared by the Government with effect from 01.01.2020 is concerned, it falls well within the domain of the Central Government to decide as to when to disburse the said increase. There is no obligation in law upon the Central Government to disburse the increase in Dearness Allowance/ Dearness Relief within a time bound manner. Rule 3 of All India Services (Dearness Allowance) Rules referred to above, itself empowers the Central Government to lay down the conditions subject to which Dearness Allowance may be drawn by officers of Central Government.

For the aforesaid reasons we do not find any merit in this petition and the same is, accordingly, dismissed.

VIPIN SANGHI, J

RAJNISH BHATNAGAR, J

RAJNISH BHATNAGAR, J

JUNE 01, 2020

0 comments:

Post a Comment