Jammu & Kashmir - Civil Services Regulations : Amendment

GOVERNMENT OF JAMMU AND KASHMIR

FINANCE DEPARTMENT

NOTIFICATION

Jammu, the 24th April, 2018.

SRO-

194.- In exercise of powers conferred under section 124 of the

Constitution of Jammu and Kashmir, the Governor is pleased to direct

that the following amendments shall be made in the Jammu and Kashmir

Civil Services Regulations, namely:

In the said regulations:

1. The following shall be inserted as Note 2 below Article 27(aa) and the

existing Note will be re-numbered as Note 1:-

Note 2:

The

term “Basic Pay” w.e.f 01-01-2016 shall mean the pay drawn in the

prescribed Level in the Pay Matrix, but does not include any other type

of pay like special pay, etc.

2. The following shall be inserted as proviso below Article 32:-

Provided

that with effect from 01-01-2016, Pay means the pay drawn by a

Government servant in the Level of the Pay Matrix as defined in the

Jammu & Kashmir Civil Service (Revised) Pay Rules, 2018.

3. The following shall be inserted as Article 240-A (VII) below Article 240

-A(VI):

240-A (VII):

Notwithstanding

anything contained in Article 240-A (VI) with regard to fixation of

pension and maximum limit thereof, the amount of superannuation,

special, retiring, compensation and invalid pension in respect of

Government servants who opt for revised pay levels w.e.f. 01-01-2016 and

retire on or after 01-01-2016 and have rendered the minimum qualifying

service of 28 years, shall be calculated at 50% of emoluments last drawn

subject to a minimum of Rs. 9000 per month (excluding the element of

additional pension)and a a maximum up to 50% of the highest pay in the

Govt., i.e.Rs.1,12,500. The pension of Government servants, who at the

time of retirement have rendered qualifying service of 10 years or more

but less than 28 years, will be in such proportion of the maximum

admissible pension as the qualifying service rendered by them bears to

maximum qualifying service of 28 years.

Provided that the amount

of superannuation, special, retiring, compensation and invalid pension

in respect of Government servants who opt for revised pay levels of

01-01-2016 and retire on or after 28-04-2017 and have rendered the

minimum qualifying service of 20 years, shall be calculated at 50% of

emoluments last drawn subject to a minimum of Rs.9000 per month

(excluding the element of additional pension) and a maximum up to 50% of

the highest pay in the Govt., i.e. n,12,500. The pension of Government

servants, who at the time of retirement have rendered qualifying service

of 10 years or more but less than 20 years, will be in such proportion

of the maximum admissible pension as the qualifying service rendered by

them bears to maximum qualifying service of 20 years.

Provided

further that the Government servants, who have retired on or after

01-01-2016 up to 31-03-2018 in the pre-revised Pay Scales/ Pay Bands,

shall be deemed to have actually drawn the emoluments in the revised Pay

Levels for determination of Pension.

With effect from 01-01-2016,

full pension (i.e. pension earned by rendition of not less than the

minimum qualifying service prescribed for full pension) of all the

pensioners irrespective of date of their retirement shall not be less

than 50% of the minimum of the pay applicable in the revised pay levels.

The pension shall be sanctioned with reference to total qualifying

service for pension rendered by the Government employee.

Where

pension has been provisionally sanctioned in cases occurring on or after

01-01-2016, the same shall be revised in terms of these rules. In case

where the pension has been finally sanctioned under the pre-revised

rules and if it happens to be more beneficial than the pension becoming

due under this rule, the pension already sanctioned shall not be revised

to the disadvantage of the pensioner.

4. The following shall be added as sub-rule (c) below Article 240- BB.

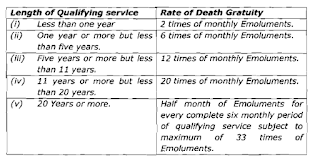

In the event of death in harness on or after 01-01-2016, the rates of

payment of death Gratuity shall be as under:

5. The following shall be added as Note 8 below Article 240-BB:

With

effect from 01-01-2016, the maximum limit of the Death-cum-Retirement

Gratuity shall be Rs. 20.00 lakh. The ceiling on DCRG will increase by

25% whenever the Dearness Allowance rises by 50% of the basic pay.

Provided

that the Government employees who have retired/died on 01-01-2016 or

may retire/die thereafter, the ‘Emoluments’ for Death¬cum-Retirement

Gratuity shall mean basic pay as defined in the Note 2 below Article

27(aa) and dearness allowance as admissible on the date of retirement.

Provided

that w.e.f 01-01-2016, the term ‘Emoluments’ for the purpose of

calculating various pensionery benefits other than ‘Retirement/Death

Gratuity’ in respect of Government servants who may retire or die while

in service shall mean “Basic Pay” as defined in the Note 2 below Article

27(aa)of these Regulations.

In respect of the Government

servants, who have elected to continue to draw pay in the pre-revised

scale of pay/ Pay Band in terms of Rule 5 of the Jammu and Kashmir Civil

Services (Revised Pay) Rules, 2018 and may retire or die while in

service on or after 01-01-2016, the pension shall be calculated in

accordance with the Rules in force immediately before the commencement

of these rules.

6. The following shall be inserted as a proviso Rule 20-(A) in Family

Pension -cum-Gratutiy Rules (Schedule XV):

Provided

that w.e.f 01-01-2016, the term "Basic Pay", for purpose of family

pension rules, shall mean basic pay as defined in the Note 2 below

Article 27(aa).

7. The following shall be inserted as proviso 4 below Rule 20(BB) of Family

Pension-cum-Gratuity Rules, 1964(Schedule XV):

Provided

that the family pension in respect of the Govt. servants who may retire

or die while in service on or after 01-01-2016 shall be computed at a

uniform rate of 30% of Basic Pay in all cases and shall be subject to

the minimum of Rs.9000/- PM and maximum of 30% of the highest pay in the

Govt. i.e. Rs.1,12,500.

However, there will be no change in the rates of enhanced family pension in

terms of Rule 20 of these Rules.

By the order of Governor of Jammu and Kashmir.

S/d,

(Navin K. Choudhary), IAS,

Principal Secretary to Government,

Finance Department.