Interesting Statistics from the 7th Pay Commission Report – Part 1

18% Vacancies in the Central Government

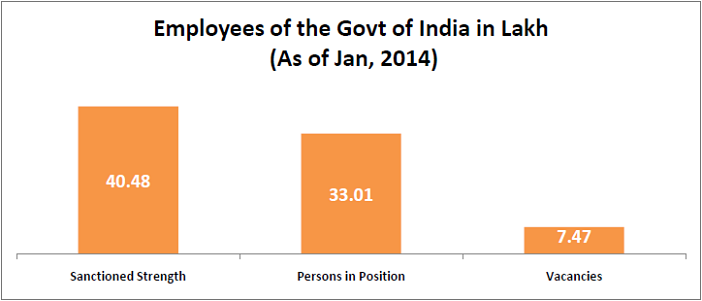

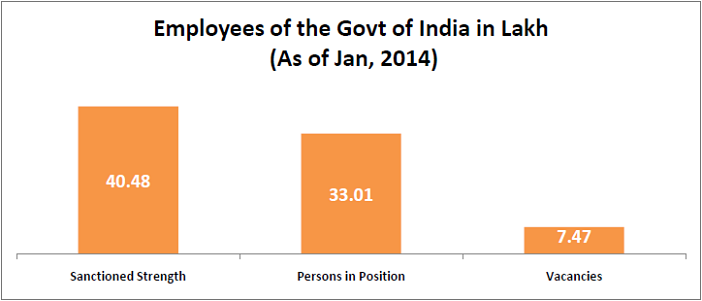

As per the CPC report, the sanctioned strength of all the departments of Government of India (including Railways) is 40.48 lakh as of 1st January 2014. Out of the sanctioned strength, only 33.01 lakh are in position, while the rest of the 7.47 lakh are lying vacant. In other words, there is are 18% vacancies in the government of India.

The Ministry of Science & Technology has 47% vacancies followed by Ministry of Finance at 46%. The other ministries that have more than 40% vacancies include Power, Civil Aviation, AYUSH, Minority Affairs & Corporate Affairs. The Election Commission also has 43% vacancies.

Railways has the largest number of employees with over 13 lakh people

Of all the ministries, the Railways has the largest number of employees with over 13 lakh followed by the Ministry of Home Affairs with over 9 lakh employees, with bulk of them from the Central Reserve forces. The Ministry of Defence has close to 4 lakh employees (excluding the military personnel). The Ministry of Communications & Information Technology has close to 2 lakh employees with bulk of them from the Department of Posts. The Ministry of Finance has close to a lakh employees with bulk of them from the Central Board of Direct Taxes and Central Excise & Customs. The Delhi Police has more than 70000 employees.

The Ministry of Drinking Water & Sanitation has the least number of employees with just 78 followed by the Ministry of Panchayati Raj with 82 employees. This is because both the ministries are not directly implementing any scheme, but are only funding the states.

89% of all the employees are from Group C

All Central Government civil posts are categorised under the Central Civil Services Rules, 1965 into three categories- Group `A’ (including the All India Service Officers), Group `B’ and Group `C’. This classification broadly corresponds to the rank, status and the degree of the level of responsibility attached to the posts. Group `A’ posts carry higher administrative and executive responsibilities and include senior management positions in the ministries/departments and field organisations. The middle and junior levels of Group `A’ along with Group `B’ constitute middle management. Group `C’ posts perform supervisory as well as operative tasks and render clerical assistances in ministries and field organisations. As per the CPC report, close to 88% of all the employees is Group C while only 3% is Group A and 9% from Group B.

The ministry of Railways has the highest number of Group C employees (close to 99%). Only 1% of the railway employees are from Group A & B. The Ministry of Home Affairs has 92% from Group C.

There are some Ministries/Departments that defy this trend and have a large number of employees in Group A. Department of Space has 57% Group A employees and same is the case with Department of Electronics & IT.

The 7th Central Pay Commission submitted its report recently, recommending a slew of measures including fixing the minimum pay of a central government employee at Rs 18000. In a two part series, we look at some of the interesting statistics from this report.The 7th Central Pay Commission(CPC) submitted its report recently. Among other things, it fixed the minimum pay in the central government at Rs 18,000/- and the maximum pay at Rs 2,25,000 at the apex level and Rs 2,50,000 for the Cabinet Secretary, Defence Chiefs etc. Here is a look at some of the interesting statistics from this report.

18% Vacancies in the Central Government

As per the CPC report, the sanctioned strength of all the departments of Government of India (including Railways) is 40.48 lakh as of 1st January 2014. Out of the sanctioned strength, only 33.01 lakh are in position, while the rest of the 7.47 lakh are lying vacant. In other words, there is are 18% vacancies in the government of India.

The Ministry of Science & Technology has 47% vacancies followed by Ministry of Finance at 46%. The other ministries that have more than 40% vacancies include Power, Civil Aviation, AYUSH, Minority Affairs & Corporate Affairs. The Election Commission also has 43% vacancies.

Railways has the largest number of employees with over 13 lakh people

Of all the ministries, the Railways has the largest number of employees with over 13 lakh followed by the Ministry of Home Affairs with over 9 lakh employees, with bulk of them from the Central Reserve forces. The Ministry of Defence has close to 4 lakh employees (excluding the military personnel). The Ministry of Communications & Information Technology has close to 2 lakh employees with bulk of them from the Department of Posts. The Ministry of Finance has close to a lakh employees with bulk of them from the Central Board of Direct Taxes and Central Excise & Customs. The Delhi Police has more than 70000 employees.

The Ministry of Drinking Water & Sanitation has the least number of employees with just 78 followed by the Ministry of Panchayati Raj with 82 employees. This is because both the ministries are not directly implementing any scheme, but are only funding the states.

89% of all the employees are from Group C

All Central Government civil posts are categorised under the Central Civil Services Rules, 1965 into three categories- Group `A’ (including the All India Service Officers), Group `B’ and Group `C’. This classification broadly corresponds to the rank, status and the degree of the level of responsibility attached to the posts. Group `A’ posts carry higher administrative and executive responsibilities and include senior management positions in the ministries/departments and field organisations. The middle and junior levels of Group `A’ along with Group `B’ constitute middle management. Group `C’ posts perform supervisory as well as operative tasks and render clerical assistances in ministries and field organisations. As per the CPC report, close to 88% of all the employees is Group C while only 3% is Group A and 9% from Group B.

The ministry of Railways has the highest number of Group C employees (close to 99%). Only 1% of the railway employees are from Group A & B. The Ministry of Home Affairs has 92% from Group C.

There are some Ministries/Departments that defy this trend and have a large number of employees in Group A. Department of Space has 57% Group A employees and same is the case with Department of Electronics & IT.