Through

its Major Schemes, Department of Financial Services is

ensuring

financial inclusion, providing social security to the people

as well as

providing credit to various sections of the society. The

major

achievements of various schemes under the Department are

highlighted

below.

1.

Pradhan Mantri Jan Dhan Yojana (PMJDY)

The

deposit base of PMJDY accounts has expanded over time. As on

05.04.2017, the deposit balance in PMJDY accounts was Rs.

63,971 crore

in 28.23 crore accounts. The average deposit per account has

more than

doubled from Rs. 1,064 in March 2015 to Rs. 2,235 in March

2017. 22.14

crore RuPay cards have been issued under PMJDY.

The Bank Mitra

network has also gained in strength and usage. The average

number of

transactions per Bank Mitra, on the Aadhaar Enabled Payment

System

operated by Bank Mitras, has risen by over eightyfold, from

52

transactions in 2014-15 to 4,291 transactions in 2016-17.

2.

Pradhan Mantri Jeevan Jyoti Bima Yojana

(PMJJBY)

As

on 12th April, 2017, Cumulative Gross enrolment

reported by Banks

subject to verification of eligibility, etc. is about 3.1

Crore under

PMJJBY. A total of 63291 claims were registered under PMJJBY

of which

59770 have been disbursed.

3.

Pradhan Mantri Suraksha Bima Yojana (PMSBY)

As

on 12th April, 2017, Cumulative Gross enrolment

reported by Banks

subject to verification of eligibility, etc. is about 10

Crore under

PMSBY. A total of 12816 claims were registered under

PMSBY of which

9646 have been disbursed.

4.

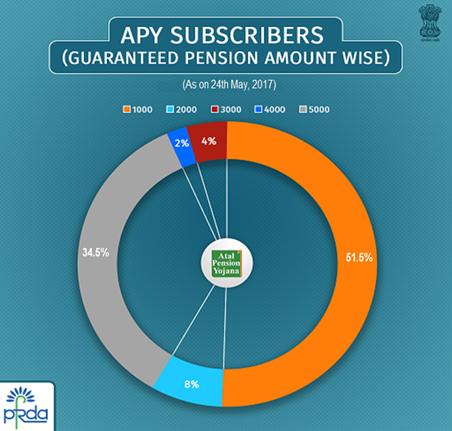

Atal Pension Yojana (APY)

As

on 31st March, 2017, a total of 48.54 lakh subscribers

have been

enrolled under APY with a total pension wealth of Rs.

1,756.48 crore.

5.

Pradhan Mantri Mudra

Yojana

Under

the scheme a loan of upto Rs. 50000 is given under sub-

scheme 'Shishu';

between Rs. 50,000 to 5.0 Lakhs under sub-scheme 'Kishore';

and between

5.0 Lakhs to 10.0 Lakhs under sub-scheme 'Tarun'.

As per latest

data, loans extended under the Pradhan Mantri Mudra Yojana

(PMMY) during

2016-17 have crossed the target of Rs. 1,80,000 crore for

2016-17.

Sanctions currently stand at Rs. 1,80,528 crore. Of this

amount, about

Rs. 1,23,000 crore was lent by banks while non-banking

institutions lent

about Rs. 57,000 crore.

Data compiled so far indicates that the

number of borrowers this year were about 4 crore, of which

over 70% were

women borrowers. About 18% of the borrowers were from the

Scheduled

Caste Category, 4.5% from the Scheduled Tribe Category, while

Other

Backward Classes accounted for almost 34% of the

borrowers.

6.

Stand Up India Scheme

The

Scheme facilitates bank loans between Rs.10 lakh and Rs.1

crore to at

least one Scheduled Caste/ Scheduled Tribe borrower and at

least one

Woman borrower per bank branch for setting up greenfield

enterprises.

This enterprise may be in manufacturing, services or the

trading sector.

As

on 11th April, 2017, Rs 5807.7 crore has been

sanctioned in 28444

accounts. Of these, women hold 22708 accounts with sanctioned

loan of Rs

4740.11 crore, Scheduled Caste persons hold 4487 accounts

with

sanctioned amount of Rs 825.17 crore while Scheduled Tribe

persons hold

1249 accounts with a sanctioned amount of Rs. 242.43

crore.

7.

Varishtha Pension Bima Yojana (VPBY)

The

revived Varishtha Pension Bima Yojana (VPBY) was formally

launched by

the Finance Minister on 14.08.2014 based on the budget

announcement made

during 2014-15 and has been opened during the window

stretching from

15th August, 2014 to 14th August, 2015. Thus all

those who subscribe to

the VPBY during this period will receive an assured

guaranteed return of

9% under the policy. As per LIC, a total number of 3,23,128

policies

with corpus amount of Rs. 9073.20 crore have been subscribed

to the

Scheme.

8.

Other Initiatives

The Government of India in the Interim Budget of FY 2014-15,

announced the setting up of

Venture Capital Fund for

Scheduled Castesunder

the head Social Sector Initiatives in order to promote

entrepreneurship among the Scheduled Castes (SC). The

scheme is

operational since 16.01.2015 with a present corpus of Rs.

290.01 crore

contributed by Ministry of Social Justice and Empowerment,

Govt. of

India (Rs. 240.01 crore) and IFCI Ltd. as sponsor and

investor (Rs. 50

crore). As of 15.03.2017, IFCI Venture Capital Fund

Ltd. has sanctioned

and disbursed Rs. 236.66 crore and Rs. 109.68 crore to 65

and 32

beneficiaries, respectively under the scheme since launch of

the scheme.

The

Credit Enhancement Guarantee Scheme (CEGS) for

Scheduled Castes (SCs) was

announced by Govt. of India in the Union Budget of 2014-15

wherein a

sum of Rs.200 crore was allocated towards credit facility

cover for

young and energetic start-up entrepreneurs, belonging to SCs,

who aspire

to be part of neo middle class category with an objective to

encourage

entrepreneurship in the lower strata of the society resulting

in job

creation besides creating confidence in SCs.

Banks have undertaken

Financial

Literacy programmes

through 718 Financial Literacy and Credit Counselling

Centres (FLCCs). A

total of 17,422 skilling centres have been mapped with

branches and

literacy centres, and financial literacy imparted to 7 lakh

students.

The literacy materials have been developed in regional

languages and

disseminated.

Card acceptance infrastructure:

To augment card acceptance infrastructure for use of debit

cards, a

major drive was undertaken between December 2016 and March

2017,

resulting in an increase in the number of Point of Sale (PoS)

terminals

by an additional 12.54 lakh, up from 15.19 lakh as on

30.11.2016.

Further, to improve such infrastructure in villages, 2.04

lakh PoS

terminals have been sanctioned from the

Financial

Inclusion Fund by NABARD.

PIB