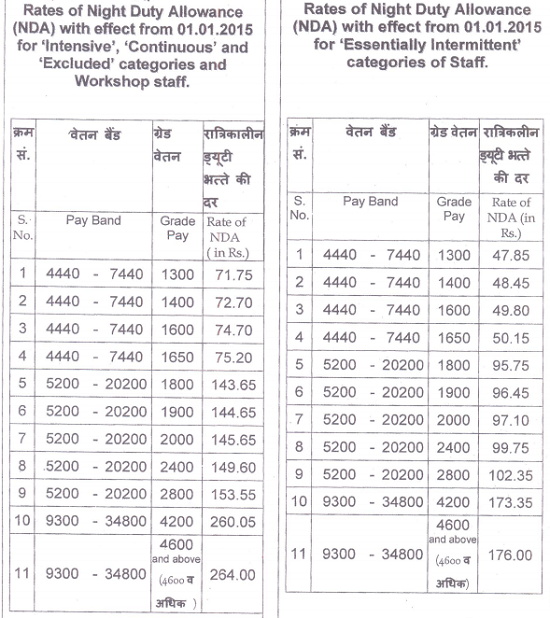

Rates of Night Duty Allowance w.e.f. 01.01.2015 for Railway Industrial Employees and Staff

G.I., Min. of Railways, Railway Board Orders RBE No.58/2015, E(P&A)II-2015/HW-1, dated 8.6.2015

Subject: Rates of Night Duty Allowance w.e.f. 01.01.2015.

Consequent to sanction of an additional instalment of Dearness Allowance vide this Ministry’s letter No. PC-VI/2008/I/7/211 dated 13.04.2015, the President is pleased to decide that the rates of Night Duty Allowance, as notified vide Annexures ‘A’ and ‘B’ of Board’s letter No. E(P&A)II-2014/HW-1 dated 02.12.2014 stand revised with effect from 01.01.2015 as indicated at Annexure ‘A’ in respect of ‘Continuous’, ‘Intensive’, ‘Excluded’ categories and workshop employees, and as indicated at Annexure ‘B’ in respect of ‘Essentially Intermittent’ categories.

Source: AIRF

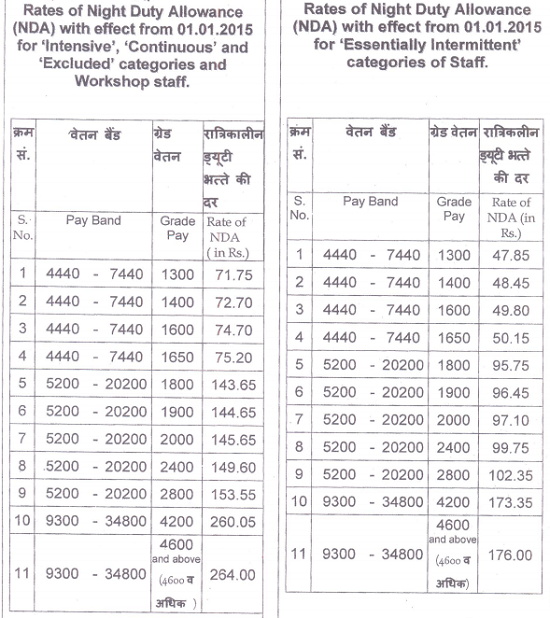

G.I., Min. of Railways, Railway Board Orders RBE No.58/2015, E(P&A)II-2015/HW-1, dated 8.6.2015

Subject: Rates of Night Duty Allowance w.e.f. 01.01.2015.

Consequent to sanction of an additional instalment of Dearness Allowance vide this Ministry’s letter No. PC-VI/2008/I/7/211 dated 13.04.2015, the President is pleased to decide that the rates of Night Duty Allowance, as notified vide Annexures ‘A’ and ‘B’ of Board’s letter No. E(P&A)II-2014/HW-1 dated 02.12.2014 stand revised with effect from 01.01.2015 as indicated at Annexure ‘A’ in respect of ‘Continuous’, ‘Intensive’, ‘Excluded’ categories and workshop employees, and as indicated at Annexure ‘B’ in respect of ‘Essentially Intermittent’ categories.

Source: AIRF