Jammu & Kashmir - Civil Services Regulations : Amendment

GOVERNMENT OF JAMMU AND KASHMIR

FINANCE DEPARTMENT

FINANCE DEPARTMENT

NOTIFICATION

Jammu, the 24th April, 2018.

SRO-

194.- In exercise of powers conferred under section 124 of the

Constitution of Jammu and Kashmir, the Governor is pleased to direct

that the following amendments shall be made in the Jammu and Kashmir

Civil Services Regulations, namely:In the said regulations:

1. The following shall be inserted as Note 2 below Article 27(aa) and the existing Note will be re-numbered as Note 1:-

Note 2:

The term “Basic Pay” w.e.f 01-01-2016 shall mean the pay drawn in the prescribed Level in the Pay Matrix, but does not include any other type of pay like special pay, etc.

2. The following shall be inserted as proviso below Article 32:-

Provided that with effect from 01-01-2016, Pay means the pay drawn by a Government servant in the Level of the Pay Matrix as defined in the Jammu & Kashmir Civil Service (Revised) Pay Rules, 2018.

3. The following shall be inserted as Article 240-A (VII) below Article 240 -A(VI):

240-A (VII):

Notwithstanding anything contained in Article 240-A (VI) with regard to fixation of pension and maximum limit thereof, the amount of superannuation, special, retiring, compensation and invalid pension in respect of Government servants who opt for revised pay levels w.e.f. 01-01-2016 and retire on or after 01-01-2016 and have rendered the minimum qualifying service of 28 years, shall be calculated at 50% of emoluments last drawn subject to a minimum of Rs. 9000 per month (excluding the element of additional pension)and a a maximum up to 50% of the highest pay in the Govt., i.e.Rs.1,12,500. The pension of Government servants, who at the time of retirement have rendered qualifying service of 10 years or more but less than 28 years, will be in such proportion of the maximum admissible pension as the qualifying service rendered by them bears to maximum qualifying service of 28 years.

Provided that the amount of superannuation, special, retiring, compensation and invalid pension in respect of Government servants who opt for revised pay levels of 01-01-2016 and retire on or after 28-04-2017 and have rendered the minimum qualifying service of 20 years, shall be calculated at 50% of emoluments last drawn subject to a minimum of Rs.9000 per month (excluding the element of additional pension) and a maximum up to 50% of the highest pay in the Govt., i.e. n,12,500. The pension of Government servants, who at the time of retirement have rendered qualifying service of 10 years or more but less than 20 years, will be in such proportion of the maximum admissible pension as the qualifying service rendered by them bears to maximum qualifying service of 20 years.

Provided further that the Government servants, who have retired on or after 01-01-2016 up to 31-03-2018 in the pre-revised Pay Scales/ Pay Bands, shall be deemed to have actually drawn the emoluments in the revised Pay Levels for determination of Pension.

With effect from 01-01-2016, full pension (i.e. pension earned by rendition of not less than the minimum qualifying service prescribed for full pension) of all the pensioners irrespective of date of their retirement shall not be less than 50% of the minimum of the pay applicable in the revised pay levels. The pension shall be sanctioned with reference to total qualifying service for pension rendered by the Government employee.

Where pension has been provisionally sanctioned in cases occurring on or after 01-01-2016, the same shall be revised in terms of these rules. In case where the pension has been finally sanctioned under the pre-revised rules and if it happens to be more beneficial than the pension becoming due under this rule, the pension already sanctioned shall not be revised to the disadvantage of the pensioner.

4. The following shall be added as sub-rule (c) below Article 240- BB.

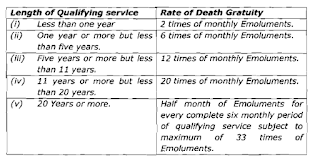

In the event of death in harness on or after 01-01-2016, the rates of payment of death Gratuity shall be as under:

5. The following shall be added as Note 8 below Article 240-BB:

With effect from 01-01-2016, the maximum limit of the Death-cum-Retirement Gratuity shall be Rs. 20.00 lakh. The ceiling on DCRG will increase by 25% whenever the Dearness Allowance rises by 50% of the basic pay.

Provided that the Government employees who have retired/died on 01-01-2016 or may retire/die thereafter, the ‘Emoluments’ for Death¬cum-Retirement Gratuity shall mean basic pay as defined in the Note 2 below Article 27(aa) and dearness allowance as admissible on the date of retirement.

Provided that w.e.f 01-01-2016, the term ‘Emoluments’ for the purpose of calculating various pensionery benefits other than ‘Retirement/Death Gratuity’ in respect of Government servants who may retire or die while in service shall mean “Basic Pay” as defined in the Note 2 below Article 27(aa)of these Regulations.

In respect of the Government servants, who have elected to continue to draw pay in the pre-revised scale of pay/ Pay Band in terms of Rule 5 of the Jammu and Kashmir Civil Services (Revised Pay) Rules, 2018 and may retire or die while in service on or after 01-01-2016, the pension shall be calculated in accordance with the Rules in force immediately before the commencement of these rules.

6. The following shall be inserted as a proviso Rule 20-(A) in Family Pension -cum-Gratutiy Rules (Schedule XV):

Provided that w.e.f 01-01-2016, the term "Basic Pay", for purpose of family pension rules, shall mean basic pay as defined in the Note 2 below Article 27(aa).

7. The following shall be inserted as proviso 4 below Rule 20(BB) of Family Pension-cum-Gratuity Rules, 1964(Schedule XV):

Provided that the family pension in respect of the Govt. servants who may retire or die while in service on or after 01-01-2016 shall be computed at a uniform rate of 30% of Basic Pay in all cases and shall be subject to the minimum of Rs.9000/- PM and maximum of 30% of the highest pay in the Govt. i.e. Rs.1,12,500.

However, there will be no change in the rates of enhanced family pension in terms of Rule 20 of these Rules.

By the order of Governor of Jammu and Kashmir.

S/d,

(Navin K. Choudhary), IAS,

Principal Secretary to Government,

Finance Department.

(Navin K. Choudhary), IAS,

Principal Secretary to Government,

Finance Department.

0 comments:

Post a Comment