Latest DoPT Orders 2020

F.No.11013/9/2014-Estt. A.III

Government of India

Ministry of Personnel, Public Grievances and Pensions

(Department of Personnel and Training)

Government of India

Ministry of Personnel, Public Grievances and Pensions

(Department of Personnel and Training)

North Block, New Delhi

Dated the 5th June, 2020

Dated the 5th June, 2020

OFFICE MEMORANDUM

Subject: Preventive measures to be taken to contain the spread of Novel Coronavirus (COVID-19) – Attendance regarding.

The undersigned is directed to refer to OM of even number dated the 17th March, 2020, 18th May, 2020 and 19th May, 2020 whereby advisory for well-being of Government employees and attendance in Government offices with staggered timings were issued by Department of Personnel & Training (DoPT).

Also check: Daily attendance is being sought by DoPT telaphonically, officers are requested to convey attendance by 11 am

2. Kind attention is also drawn to Ministry of Home Affairs’ Order dated 30.05.2020 whereby ‘Additional Directives for Work Places’ have been prescribed. Further, the Ministry of Health & Family Welfare (MoH&FW) on 4th June, 2020 has issued Standard Operating Procedure on preventive measures to contain spread of COVID-19 in workplace settings (copy enclosed).

3. It is emphasized that strict adherence to the practices of social distancing norms and health & hygiene practices, as enunciated in these guidelines, is of paramount importance and the Government servants as responsible employees should abide by these practices so that the Government offices function in the most efficient manner in the given situation. All the Ministries / Departments/offices as well as the Central Government employees are, therefore, directed to ensure strict compliance of instructions issued by DoPT as well as MHA and MoH&FW.

(Umesh Kumar Bhatra)

Deputy Secretary to the Govt. of India

Deputy Secretary to the Govt. of India

4th June, 2020

Government of IndiaMinistry of Health & Family Welfare

SOP on preventive measures to contain spread of COVID-19 in offices

1. Background

Offices and other workplaces are relatively close settings, with shared spaces like work stations, corridors, elevators & stairs, parking places, cafeteria, meeting rooms and conference halls etc. and COVID-19 infection can spread relatively fast among officials, staffs and visitors.

There is a need to prevent spread of infection and to respond in a timely and effective manner in case suspect case of COVID-19 is detected in these settings, so as to limit the spread of infection.

2. Scope

This document outlines the preventive and response measures to be observed to contain the spread of COVID-19 in office settings. The document is divided into the following sub-sections

(i) Generic preventive measures to be followed at all times

(ii) Measures specific to offices

(iii) Measures to be taken on occurrence of case(s)

(iv) Disinfection procedures to be implemented in case of occurrence of suspect / confirmed case.

Offices in containment zones shall remain closed except for medical & essential sevices. Only those outside containment zones will be allowed to open up.

3. Generic preventive measures

Persons above 65 years of age, persons with comorbidities, pregnant women are advised to stay at home, except for essential and health purposes. Office management to facilitate the process.

The generic preventive measures include simple public health measures that are to be followed to reduce the risk of infection with COVID-19. These measures need to be observed by all (employees and visitors) at all times. These include:

i. Individuals must maintain a minimum distance of 6 feet in public places as far as feasible.

ii. Use of face covers/masks to be mandatory.

iii. Practice frequent hand washing with soap (for at least 40-60 seconds) even when hands are not visibly dirty. Use of alcohol-based hand sanitizers (for at least 20 seconds) can be made wherever feasible.

iv. Respiratory etiquettes to be strictly followed. This involves strict practice of covering one’s mouth and nose while coughing/sneezing with a tissue / handkerchief / flexed elbow and disposing off used tissues properly.

v. Self-monitoring of health by all and reporting any illness at the earliest to the immediate supervisory officer.

vi. Spitting shall be strictly prohibited.

vii. Installation & use of Aarogya Setu App by employees.

4. Specific preventive measures for offices:

i. Entrance to have mandatory hand hygiene (sanitizes dispenser) and thermal screening provisions.

ii. Only asymptomatic staff/visitors shall be allowed.

iii. Any officer and staff residing in containment zone should inform the same to supervisory officer and not attend the office till containment zone is denotified. Such staff should be permitted to work from home and it will not be counted as leave period.

iv. Drivers shall maintain social distancing and shall follow required dos and don’ts related to COVID-19. It shall be ensured by the service providers/ officers/ staff that drivers residing in containment zones shall not be allowed to drive vehicles.

v. There shall be provision for disinfection of the interior of the vehicle using 1% sodium hypochlorite solution/ spray. A proper disinfection of steering, door handles, keys, etc. should be taken up.

vi. Advise all employees who are at higher risk i.e. older employees, pregnant employees and employees who have underlying medical conditions, to take extra precautions. They should preferably not be exposed to any front-line work requiring direct contact with the public. Office management to facilitate work from home wherever feasible.

vii. All officers and staff / visitors to be allowed entry only if using face cover/masks. The face cover/mask has to be worn at all times inside the office premises.

viii. Routine issue of visitors/ temporary passes should be suspended and visitors with proper permission of the officer who they want to meet, should be allowed after being properly screened.

ix. Meetings, as far as feasible, should be done through video conferencing.

x. Posters/ standees/ AV media on preventive measures about COVID-19 to be displayed prominently.

xi. Staggering of office hours, lunch hours/coffee breaks to be done, as far as feasible.

xii. Proper crowd management in the parking lots and outside the premises – duly following social distancing norms be ensured.

xiii. Valet parking, if available, shall be operational with operating staff wearing face covers/ masks and gloves as appropriate. A proper disinfection of steering, door handles, keys, etc. of vehicles should be taken up.

xiv. Any shops, stalls, cafeteria etc., outside and within the office premises shall follow social distancing norms at all times.

xv. Specific markings may be made with sufficient distance to manage the queue and ensure social distancing in the premises.

xvi. Preferably separate entry and exit for officers, staff and visitors shall be organised.

xvii. Proper cleaning and frequent sanitization of the workplace, particularly of the frequently touched surfaces must be ensured.

xviii. Ensure regular supply of hand sanitisers, soap and running water in the washrooms.

xix. Required precautions while handling supplies, inventories and goods in the office shall be ensured.

xx. Seating arrangement to be made in such a way that adequate social distancing is maintained.

xxi. Number of people in the elevators shall be restricted, duly maintaining social distancing norms.

xxii. For air-conditioning/ventilation, the guidelines of CPWD shall be followed which inter alia emphasises that the temperature setting of all air conditioning devices should be in the range of 24-30°C, relative humidity should be in the range of 40¬70%, intake of fresh air should be as much as possible and cross ventilation should be adequate.

xxiii. Large gatherings continue to remain prohibited.

xxiv. Effective and frequent sanitation within the premises shall be maintained with particular focus on lavatories, drinking and hand washing stations/areas.

xxv. Cleaning and regular disinfection (using 1% sodium hypochlorite) of frequently touched surfaces (door knobs, elevator buttons, hand rails, benches, washroom fixtures, etc.) shall be done in office premises and in common areas

xxvi. Proper disposal of face covers / masks / gloves left over by visitors and/or employees shall be ensured.

xxvii. In the cafeteria/canteen/dining halls:

a.Adequate crowd and queue management to be ensured to ensure social distancing norms.

b. Staff / waiters to wear mask and hand gloves and take other required precautionary measures.

c.The seating arrangement to ensure a distance of at least 1 meter between patrons as far as feasible.

d. In the kitchen, the staff to follow social distancing norms.

5. Measures to be taken on occurrence of case(s):

Despite taking the above measures, the occurrence of cases among the employees working in the office cannot be ruled out. The following measures will be taken in such circumstances:

i. When one or few person(s) who share a room/close office space is/are found to be suffering from symptoms suggestive of COVID-19:

- Place the ill person in a room or area where they are isolated from others at the workplace. Provide a mask/face cover till such time he/she is examined by a doctor.

- Immediately inform the nearest medical facility (hospital/clinic) or call the state or district helpline.

- A risk assessment will be undertaken by the designated public health authority (district RRT/treating physician) and accordingly further advice shall be made regarding management of case, his/her contacts and need for disinfection.

- The suspect case if reporting very mild/mild symptoms on assessment by the health authorities would be placed under home isolation.

- Suspect case, if assessed by health authorities as moderate to severe, will be treated as per health protocol in appropriate health facility.

- The rapid response team of the concerned district shall be requisitioned and will undertake the listing of contacts.

- The necessary actions for contact tracing and disinfection of work place will start once the report of the patient is received as positive. The report will be expedited for this purpose.

iii. Management of contacts:

- The contacts will be categorised into high and low risk contacts by the District RRTas detailed in the Annexure I.

- The high-risk exposure contacts shall be quarantined for 14 days.

- These persons shall undergo testing as per ICMR protocol.

- The low risk exposure contacts shall continue to work and closely monitor their health for next 14 days.

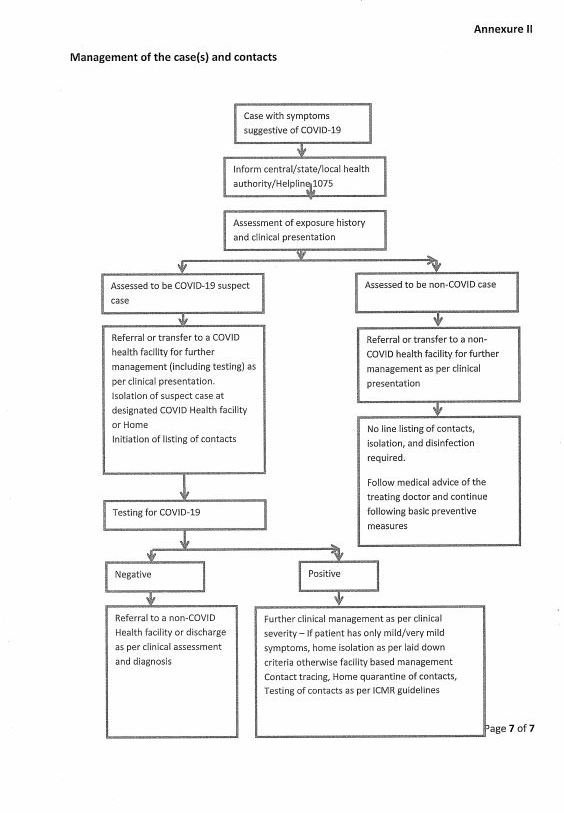

- The flowchart for management of contact/ cases is placed at Annexure – II.

i. If there are one or two cases reported, the disinfection procedure will be limited to places/areas visited by the patient in past 48 hrs. There is no need to close the entire office building/halt work in other areas of the office and work can be resumed after disinfection as per laid down protocol.

ii. However, if there is a larger outbreak, the building/block will have to be closed for 48 hours after thorough disinfection. All the staff will work from home, till the building/block is adequately disinfected and is declared fit for re-occupation.

7. Disinfection Procedures in Offices

Detailed guidelines on the disinfection as already issued by Ministry of Health & Family Welfare as available on their website shall be followed.

Annexure I

Risk profiling of contacts

Contacts are persons who have been exposed to a confirmed case anytime between 2 days prior to onset of symptoms (in the positive case) and the date of isolation (or maximum 14 days after the symptom onset in the case).

High-risk contact

- Touched body fluids of the patient (respiratory tract secretions, blood, vomit, saliva, urine, faeces; e.g. being coughed on, touching used paper tissues with a bare hand)

- Had direct physical contact with the body of the patient including physical examination without PPE

- Touched or cleaned the linens, clothes, or dishes of the patient.

- Lives in the same household as the patient.

- Anyone in close proximity (within 1 meter) of the confirmed case without precautions.

- Passengers in close proximity (within 1 meter) in a conveyance with a symptomatic person who later tested positive for COVID-19 for more than 6 hours.

- Shared the same space (worked in same room/similar) but not having a high-risk exposure to confirmed case of COVID-19.

- Travelled in same environment (bus/train/flight/any mode of transit) but not having a high-risk exposure.