LDC-UDC Matter & MACP on Promotional Hierarchy in 7th CPC Recommendation: AIAAS(NG) writes to Confederation

Message from Secretary AIAAS(NG) :-

Com. M Krishnan,

Secretary General,

Confederation of Central Government Employees & Workers,

New Delhi

Message from Secretary AIAAS(NG) :-

This Association has taken up the LDC/UDC, MACP on Promotional

Hierarchy, and other issues related to Administrative Staff with

Confederation. Copy of the letter sent to the Secretary General,

Confederation is given below: All our LDC/UDC friends are requested to

raise the issue in their respective Association to force them to

represent the issue to Confederation/JCM Staff Side.

ALL INDIA ASSOCIATION OF ADMINISTRATIVE STAFF (NG)

MINISTRY OF STATISTICS AND PROGRAMME IMPLEMENTATION

Bhopal,

Dated 25/11/2015

ToCom. M Krishnan,

Secretary General,

Confederation of Central Government Employees & Workers,

New Delhi

Dear comrade,

III The Grade Pay of Assistants/Stenographers of Central Secretariat is brought down to Rs. 4200 from the existing Rs. 4600 and NFSG granted to the UDCs of Central Secretariat has been withdrawn thereby the demand for parity with the Grade Pay of Assistant/UDC of Central Secretariat is turned down.

This is in connection with LDC/UDC, MACP on Promotional hierarchy

and other issues related to Administrative Staff of Subordinate offices.

It is surprising to note that the 7th Pay Commission has turned down

the genuine issue of LDC & UDC on the ground that the government has

stopped direct recruitment for the clerical cadre and gradually phasing

out the existing incumbents. If this is true, it is a matter of great

concern that the Government has chosen to take a unilateral decision on

an important policy matter without consulting the Staff side. The reason

given for rejection of the demand is not convincing.

Besides Confederation/Staff Side JCM, several Departments had

recommended upgradation of grade pay of LDC & UDC of Administrative

Offices especially the LDC & UDCs of subordinate offices of

Government of India.

Extracts of the Pay Commission comments on the matter is given below:

By analyzing the demand of SVP, National Police Academy under Para

11.22.100 the Commission has said “This issue has been dealt in Chapter

7.7. Recommendations made there would apply in this case also”

As against the demand of Directorate of Printing under Para

11.52.32 Commission maintained that “posts like LDC, UDC, Accountant are

common to a number of ministries/ departments. Recommendations

regarding their pay are contained in Chapter 7.7 and Chapter 11.35.”

But, in Chapter 7.7, deals common category, no recommendation for LDC/UDC is given.

However by recording disagreement to increase promotional quota of

MTS to LDC under Para 7.7.37 & 11.35.28 Commission has said that

“government has already stopped direct recruitment for the clerical

cadre and gradually phasing out the existing incumbents, this demand

cannot be accepted.”

But the fact is that Staff Selection Commission is frequently

conducting recruitment for the post of LDC. Combined higher secondary

examination for the selection of LDC also has been conducted recently.

Moreover, no alternative recommendation to replace the LDC post is given

in the report. It is to be noted that the normal ratio of LDC and UDC

in subordinate offices is 5:2 and thus LDCs have been allocated

responsible sections and in many smaller offices LDC alone is handling

the work of entire Administration.

On the other hand rejecting Central Secretariat Clerical service

demand for parity with DEO, the commission observes “Even though the

entry requirements are similar, historically the pay scales of the two

posts have been different. Besides, they comprise two distinct cadres

with different set of roles and responsibilities. Hence, the demand for

parity of pay of LDC with DEOs cannot be acceded to by the

Commission.”(Para 11.35.38).

Historically these cadres may be different set of roles but the

fact is that functions of LDC are more complex than that of DEO and same

was brought before the commission by various

Associations/Administrative Authorities. Earlier pay Commissions have

fixed Pay Scale to DEO considering their work on computer. But today

LDCs are selected on the basis of their expertise in computer operation

also.

By concluding the LDC issue, I give hereunder two comments among

the dozens of comments/e-mail received us on the subject. This signifies

the sufferings of LDCs in subordinate offices.

(1) I am really disappointed with the decision of 7th CPC, I was

hoping that I would get atleast GP 2400 as per their calculation, they

don’t even think about lower classMyself Ashutosh, LDC and I am

appointed on 2012, 3000 KM far from my house and from last 2 years I am

doing the work of cashier along with all the work of Income Tax and

budget, apart from me 4 more LDC’s are working here instead of UDC’s and

they are the backbone of their branch but as per 7th CPC words we are

not having as much responsible work they think LDC’s are recruits only

for “dispatch” and “typing” which is not true.

I request to them, sir please come and see how much responsibility we have and what we are getting,

(2) I am s murugan LDC, handling with pay bills, income tax, TDS

and what are related to taxable income such as LTC encashment, final

bills, HRA claim and etc…

In 7th Cpc report every where it is stated that this is dealt with

chapter 7.7 and 11.35. But, there are no clear instructions for

clerical.

The major error is clerical cadre is not included in common categories (chapter 7).

II Grant of MACP on Promotional Hierarchy:

Even though the Confederation has clarified that the Commission has

recommended MACP on promotional hierarchy, the report of the Commission

is confusing and contradictory. Para 5.1.44 reads in the new Pay

matrix, the employees will move to the immediate next level in the

hierarchy. This can be interpreted as fixation in the same principle as

that for a regular promotion. But Para 11.52.45 is contradictory.

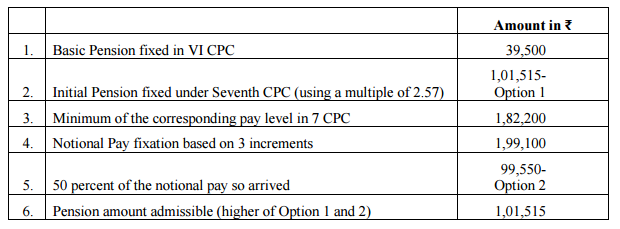

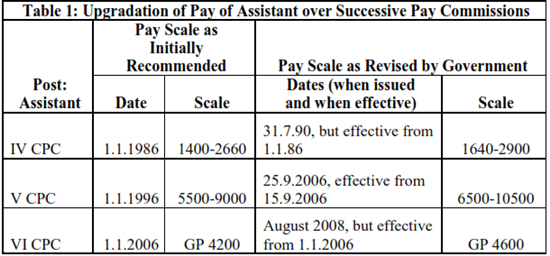

III The Grade Pay of Assistants/Stenographers of Central Secretariat is brought down to Rs. 4200 from the existing Rs. 4600 and NFSG granted to the UDCs of Central Secretariat has been withdrawn thereby the demand for parity with the Grade Pay of Assistant/UDC of Central Secretariat is turned down.

Comrades, Government is bent upon to contractorise all the

Administrative posts below the post of Assistants. The demand for merger

of Grade Pay of LDC & UDC and upgradation to Rs. 2800, as

recommended by the staff side is genuine in accordance with duties

assigned. Confederation/JCM (Staff Side) is requested to please help

LDC/UDC and other Administrative Staff of subordinate Offices to resolve

these genuine issues.

Yours fraternally

TKR Pillai

General Secretary

General Secretary

Source: http://aiamshq.blogspot.in/2015/11/this-association-has-taken-upthe-ldcudc.html