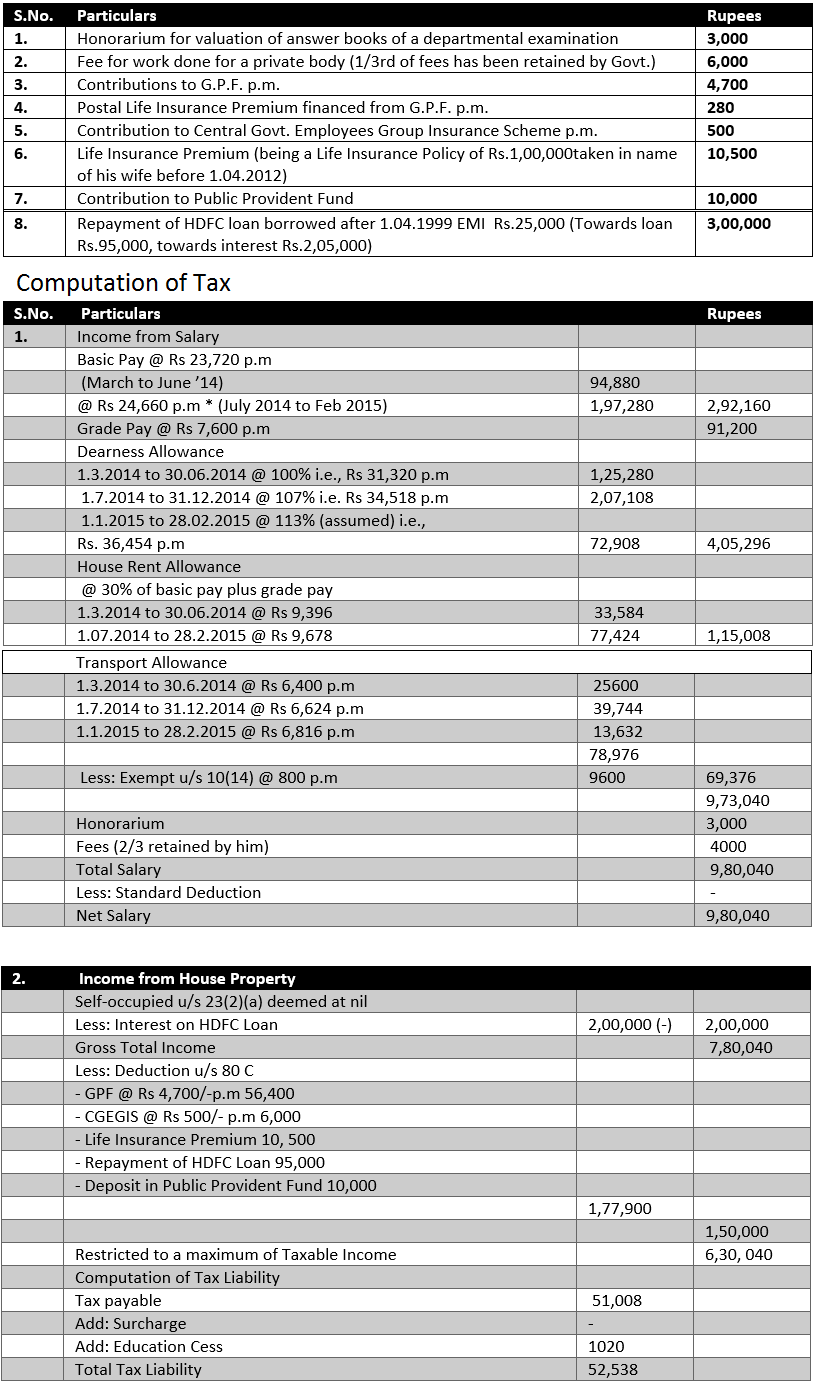

Income Tax Calculation for Interest on Housing Loan and Deduction u/s 80C with illustration

One Computation of Taxable Salary and allowances, Deduction for Interest on Housing Loan and Deduction u/s 80C.

Mr. X, a Central Govt. Officers in

Delhi, is receiving Basic Pay Rs.23,720, grade Pay Rs.7,600, DA at

prescribed rates, transport allowances @ Rs.3200+DA thereon, and HRA 30%

of basic pay + grade pay (though living in his own house). His date of

increment is Ist July. The following are other particulars of his

income. Compute his taxable income and tax payable, for A.Y.2015-16.

Authority: IT Circular issued by CBDT on 1.12.2015

0 comments:

Post a Comment